Describe Methods Used to Verify Inventory

FIFO and LIFO. LIFO and FIFO are methods to determine the cost of inventory.

Inventory Audit Audit Procedures For Inventory

Inventory Costing Methods What inventory costing method you use depends on pricing and as basic as it sounds it is important that you know the difference between price and cost.

. Get your free inventory management spreadsheet. I During physical verification neither the stores nor the works are to be closed. Under this method physical stock verification is spread throughout the year according to a predetermined programme.

In this article well take you through the five ways to value your inventory. Methods used to verify inventory. Inventory Management Companies make replenishment decisions when managing inventory.

There are three main types of inventory cycle counts that you can use. FIFO and LIFO are accounting methods used to value your inventory and report your profitability. In this article we go through four inventory costing methods to help you decide which is best suited to your business.

An ABC analysis includes grouping different value and volume inventory. Each company chooses a systematic approach to calculating and reporting its inventory turnover and regulators expect them to stick to that method every year. The retail inventory method The specific identification method The First In First Out FIFO method The Last In First Out LIFO method The weighted average method Lets dive in.

The three most widely used methods for inventory valuation are First-In First-Out FIFO Last-In First-Out LIFO Weighted Average Cost Inventory valuation method is the way to calculate the total value of the inventory owned by a company at any particular time. FIFO is a great way to keep inventory fresh. And each item is physically examined at least once a year.

Describe the experiment used to verify the third law. The 4 inventory costing methods for effective stock valuation. Computer Assisted Audit Technique CAAT Do You Need Assistance with any of the Five Test Methods for Your Upcoming Audit.

Four main advantages of perpetual verification are. Describe methods used to verify inventory. First-In First-Out Method Last-In First-Out Method Average Cost Method First-in-First-Out Method FIFO According to FIFO it is assumed that items from the inventory are sold in the order in which they are purchased or produced.

There are three common methods for inventory accountability in the US. First in first out FIFO method. The basic work in this always better control analysis is the classification and identification of different types of inventories for determining the degree of control required for each.

Some common inventory audit procedures are. If you apply overhead costs to the inventory valuation then the auditors will verify that you are consistently using the same general ledger accounts as the source for your overhead costs whether overhead includes any abnormal costs which should be charged to expense as incurred and test the validity and consistency of the method used to apply overhead costs to. Type 2 Engagements for SOC 1 and SOC 2 Audits Require Their Share of.

Describe the two most commonly used inventory valuation methods. The method companies use to cost their inventory directly guides the income and inventory value they report on their financial statements. Batch tracking is sometimes referred to as lot tracking and its a process for efficiently tracing goods along the distribution chain using batch numbers.

DSI is calculated by taking the average annual inventory dividing it by the cost of goods sold COGS for the same period and multiplying the result by. LIFO helps prevent inventory from going bad. In many firms it is found that they have stocks which are used at very different rates.

There are four main methods to compute COGS and ending. Describe methods used to verify the quality of the intervention. FIFO or First in First out assumes the older inventory is sold first.

Propose methods to implement an existing treatment plan. Last in first out LIFO method. In this chapter you will study different types of inventory and how companies use those inventories the costs of different inventory policies inventory-management objectives and performance measures.

Generally Accepted Accounting Principles GAAP allows all three methods to be used. Control group cycle counting This type of cycle counting focuses on counting the same items many times over a short period. Use the example of S the data as below.

Order Status and Tracking. The items can be tracked and stored in their separate value groups as well. The inventory value is calculated based on the total cost incurred in purchasing the inventory and getting it ready for.

These methods of inventory management monitor past demands and calculate how much inventory youll need in the future. Rate of inventory turnover. Methods and Techniques of Inventory Control 1.

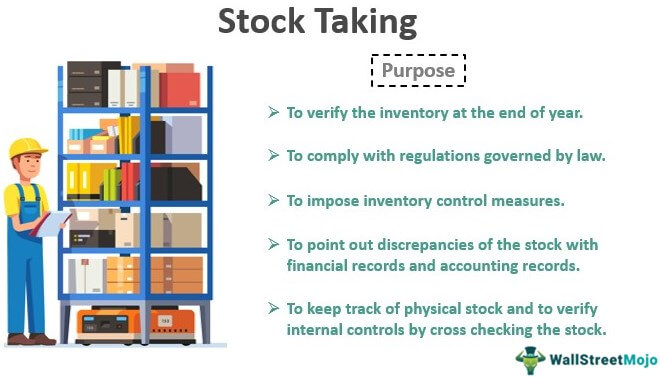

For example high-value inventory mid-value and low-value products can be grouped separately. Inventory write-off and inventory write-down. Physical inventory count- each inventory is measured before and after movement manually and physically Inventory management systems like ERP are used nowadays to ensure the right count of any kind of inventory movement.

Smonocinic Stable to 3685K Srhombic Stable above 3685K Stho SolutionInn. FIFO first in first out is an inventory accounting method that says the first items in your inventory are the first ones that leave. LIFO or Last-in First-out assumes the newer inventory is typically sold first.

The repeated counting reveals errors in the count technique which can then be rectified to design an accurate count procedure. Following are the most widely used inventory valuation methods. Differences Between Types of Costs As policymakers and healthcare managers consider various ways to contain the rising costs of health care it is useful to examine the patterns and elements of health care costs that are needed to run the United States delivery system.

To help this post will describe the best inventory valuation methods and how each of them impacts your business. You may choose to build off a completed treatment plan that you developed in a previous course at Capella PSY7706 or. The Five Types of Testing Methods Used During Audit Procedures 1.

Inventory count can be ensured by general. Examination or Inspection of Evidence 4.

Inventory Audit Importance And Objectives Of Inventory Audit

No comments for "Describe Methods Used to Verify Inventory"

Post a Comment